If you’re working on building up your savings, keeping your funds in an interest savings account, aka high yield savings account, is a great option.

Savings is post-tax cash, not in a retirement account, that you can use for a down payment on a house, for emergencies, to open (or buy) a business, to buy a sailboat and sail away, or use for whatever tickles your fancy.

Where I Don’t Keep My Savings

I worked with a lady who kept her “cold cash” in her freezer. She had $2,000 hidden in an empty box of frozen waffles. One day her electricity went out and by the time the lights came back on, everything in the refrigerator was ruined. So she threw it all away. After the garbage truck hauled away their rotten food, they remembered the cold cash. It was too late. But they went to the dump anyway, and waded around in trash for a day before they finally conceded that the money was gone. Lesson? Don’t keep your savings in the freezer!

And don’t bury it in the backyard like Ron Swanson.

Lastly, don’t keep it in your checking account where it won’t accrue any interest. Plus its too tempting and oh-so-easy to spend.

Where I DO Keep My Savings

Interest Savings Account

I keep an emergency fund of cash in an interest-bearing savings account in the same bank as my primary checking account.

- A high yield savings account is a great place to keep cash. Instead of depositing actual cash at the bank, you deposit the funds into your regular checking account, and then transfer the money into your savings account with a bank transfer, which can be done online.

- These type of accounts can pay anywhere from 1.5% to 2% interest, and will go up from there as the Federal Reserve raises interest rates. If you have $25,000 in your emergency fund, a 2% interest rate will earn you an extra $500 per year. Not a huge amount, but better than zero.

- High yield savings accounts are often offered by online banks because they don’t have the brick and mortar costs involved with having physical locations. My Ally bank savings rate is currently 1.8%, down from a high of 2.2% earlier this year.

- How much should you keep in your emergency fund? Anywhere from 3 to 6 months worth of monthly living expenses. I try to keep enough in my interest savings account to cover 3 months of expenses. My reasoning is that there’s more in the brokerage if I need it.

Certificate of Deposit (CD)

A certificate of deposit is a deposit account that holds your funds for a stated amount of time, such as 12, 24, or 36 months for a specific amount of interest.

- CDs are a financial product commonly sold by banks and and credit unions.

- They are similar to savings accounts in that they are insured “money in the bank” and are virtually risk free.

- CDs pay slightly more than high yield savings account as of the time this article was written, and can tie up your funds for a year or more. If you need your funds to be accessible, a CD might not be the best choice. Do your research and check rates.

Brokerage Account

A brokerage account is an investment account you open with a brokerage firm. Unlike a bank account, you can use a brokerage account to purchase investments, including stocks, options, bonds, and mutual funds. I keep most of my savings in an online brokerage account.

-

- I like to use my funds to buy and sell stocks and options because I earn more money than I can make with bank account interest. Please study the market and different strategies extensively before jumping in.

- I use tastyworks for my brokerage, and trade equity options frequently, and prefer the options-geared platform tastyworks offers. I also love their team and the work they do over at tastytrade. I’m a big fan.

- TD Ameritrade is a good choice if you want to invest in mutual funds. They have a huge list of mutual funds to choose from, and several mutual funds with no load fees. A no-load fund is a mutual fund without a commission or sales charge.

- From a brokerage account, I can liquidate stocks or options and have my money transferred into my checking account in a week, if I need to.

- Buying stocks and options presents greater risk to your money. Make sure you consult with a licensed investment expert if you aren’t sure what products or stocks to buy and sell.

Lending Club

I invested $1,000 over a 3 year term with Lending Club to try it out.

-

- I’m earning a solid return with a low amount of risk, and will invest with Lending Club more in the future.

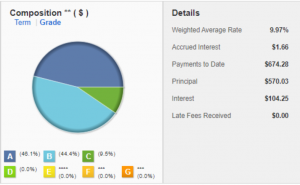

- My weighted average rate of return is 9.97%, as depicted in the snapshot I took of my account. The annual rate is more like 6.5%.

- Its not as liquid as a brokerage account, but for a 3 to 5 year term, it gives you a great return.

Lending Club Performance Snapshot

Learn how to increase your savings with a budget.

Where do you keep your savings? Share in the comments below.

I keep savings in a savings account if I need it anytime soon

That’s so funny to see people keeping money in the fridge .. haha 😂 By the way, I keep my savings in my savings account and figured out some other saving methods that work for myself.

It’s crazy, isn’t it? True story.

I use a savings account but I’ve been exploring other options, so this post was helpful. Thanks!

I know people who kept their cash in the freezer or under the bed. Or in the bible, parable of the talents, one guy buried his money in the ground. That’s a no no I always put my money to work.

I think you are spot on in advising to put money in places that are interest-bearing, which is where I tend. I wonder though — in the long run — what would happen if some how all these banks and other financial institutions “lost” our money (meaning, we couldn’t access our accounts).

Financial literacy and well-being is so important !

I usually keep mine on savings account (with 2 different banks) though I’ve been researching/reading about other ways. The lending club looks like something that I would like to try. Thank you for these suggestions!

There are alot of ways we save. And yes, these will surely help us in saving since the breakdown of the interest and everything will help a lot.

I have savings in more than one place. When I saw the title, I wasn’t sure if this was going to be a straightforward post or be a parody. LOL Thanks for the tips!

Very interesting. It’s so important we get on top of our savings. Especially with everything going on in the world right now!

So smart! I might start doing the same…

Wow, I have never heard of someone hiding their savings in a freezer. But great advice on where to actually place your cash at!

very helpful post, I will consider these tips while saving next time

I am not that keen when it comes to money. Thank you for this post, I learned a lot! I wish these spaces are also available in our country ☺❤️

Oh my gosh I can’t even imagine how sickening of a feeling that must be to know you threw out that much money. I think the safest place to keep it is in an actual savings account.

Good advice here. I wish my savings account at my bank earned more, but we need that money available for expenses. I may have to shop around for new savings accounts.

I learned a lot in this. Amazing info