Tired of vanilla books and blogs that all teach the same approach to financial independence and personal finance? Pay off your debt, save up for an emergency fund, max out your 401k. Looking for more advanced personal finance concepts? This is it. It all starts with a framework. A framework is a structure. An architecture. A logical design that you can customize to suit your personal needs and develop into a cash generating machine.

Maybe you have a great job with a 6 figure income and you think if you save enough for long enough, you can quit your job early. But wouldn’t it be a lot faster if you could make even more money that you do now AND save as much as possible?

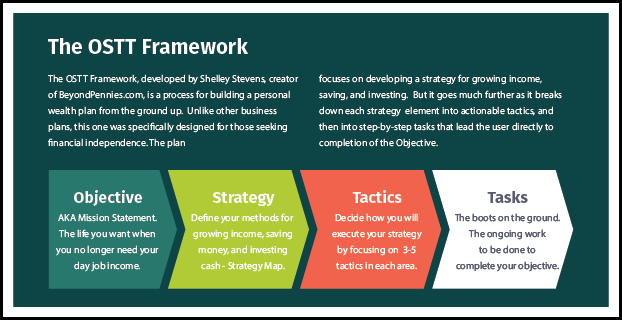

Introducing The OSTT Framework

The OSTT (Objective Strategy Tactics Tasks) framework is an architecture for those who are doing the basic things correctly with their finances, but would like to speed up the process of reaching financial freedom – Learn about the 5 Stages of Financial Freedom here. You’d like to quit your day job and do something that matters to you. But you aren’t sure how, because you’ve always worked for someone else. Maybe you have a good income that supports your lifestyle, and you aren’t sure what to do next.

This framework works in conjunction with the SBL (Stop Being Lazy) Framework, and the YNGGRWJADJ (You’re Not Gonna Get Rich With Just a Day Job) Framework. To which you reply, “I don’t wanna get rich, I just wanna be able to tell my corporate overlords to F off.”

And that, my friends, is the goal of this method. You accumulate the amount you need to live YOUR best life, and you do it in such a way that your income doesn’t completely disappear the moment you quit your day job. Don’t rely on investment returns as your only source of income outside of your day job. We all know how that could turn out.

The OSTT Framework is a step by step process that will help you build your own advanced personal finance strategy.

Step 1 – Objective (aka Mission Statement)

Before you can make a plan, you need to know 1) What your best life looks like, 2) how much its going to cost you, and 3) a target date to quit your day job. Yes, actually set a date! Its a bold move, but effective. Figure those three things out, and you’ll have step 1 complete. Read a more detailed explanation of how to write your own personal wealth mission statement.

Step 2 – Strategy

A strategy is a plan of action or policy designed to achieve a major or overall aim. Eating rice and beans for the next five years is not a strategy. Technically, its a tactic. And a terrible one. Let’s try something a bit more sophisticated. The best tool for developing your strategy is the Strategy Map. Read more about how to use it here.

The strategy map focuses on three pillars of financial independence – Income, Savings, and Investments. The basic idea is to decide on 1 to 5 income streams to focus on building during the time-frame between now and when you quit your day job. Think of side-hustles that you would want to do full time someday. Think of activities you love that you could turn into an income source. Start there and then jot down some ideas.

Then decide on your strategy for saving money. How much you will save from each income source vs how much you reinvest into your side-hustles to grow them.

The third pillar is investments. This is where you outline where your savings goes. Choose 1 to 5 investments, with a mix of short-term and long-term funds, including things like money market account for emergencies, stocks, ETFs, or mutual funds, peer-to-peer investments for mid-term (3 to 5 year) returns, real estate, etc. Your investment decisions will be based on your own risk appetite and personal expertise in various investment vehicles. The goal is to protect and grow your hard-won dollars.

Step 3 – Tactics

If the objective is why you do it, and the strategy is what you do, tactics explain how you do it. Tactics are often confused with strategy: tactics are the actual means used to gain an objective, while strategy is the overall plan, which involve more high-level patterns, activity, and decision-making that govern tactical execution. Hence, your strategy is the foundation for your tactics.

Income Stream Tactics

For each income stream, identify 3 to 5 basic tactics for achieving your targeted income. Tactics for income will differ depending on the income stream. For instance, tactics for a real estate venture will be very different than tactics for growing a blog. Do your research and figure out the top 5 things people are doing who have been successful at your specific income streams. I will cover this is much more depth in the e-course I’m working on. Opt in for updates here.

Savings Tactics

With savings strategy, I recommend simple tactics like following a budget, saving all bonuses and raises, investing 80% of income from side-hustles, or paying off any remaining debt. Do your research and figure out what makes the most sense for your situation.

Decide on a budget and savings methodology to follow. There are several out there to choose from. Its important to pick a method and be consistent. Track your earnings and your expenses, and always be mindful of treating your expenses just like you would running a business. Cut out what’s unnecessary.

Learn how to budget like a business with this post: Build Your Budget Like a Business – Transcend the Worker Mentality.

Investment Tactics

For investments, identify the tactics you will employ when choosing the amount and type of investments for each strategy. As an example, if you choose to invest in the stock market, decide if you will be choosing a value, momentum, or growth method. Or maybe you will follow the Boglehead formula. Make sure your chosen methods are in harmony with the time frame of your objective. If you want to quit your day job at 45, don’t pick investments that would work best if you retired at 65.

Decide how often to re-balance your portfolio. If you’re within a 5 year range of hitting your Objective, consider moving your assets into a safer position because you never know what’s going to happen short-term (hello Coronavirus).

Unless you absolutely nail it with your side-hustle, your investments will become one of your income streams after you quit your day job. Keep that in mind as you are making investment decisions. If you aren’t sure how to manage your assets, reach out to a professional wealth advisor for advice. To track your net worth, try the Personal Finance. It will give you a lot of valuable information about your net worth and gains over time for absolutely free. I use it as my primary net worth tracking tool.

Step 4 – Tasks

Tasks are the boots on the ground in your campaign of advanced personal finance strategy. For each tactic you decide on, you will have innumerable and ongoing tasks that need to be done to execute them. Some tasks will be learning-based, and some will be the actual steps involved in building your personal empire. Tasks will differ vastly from tactic to tactic, but I like to break income stream tasks into 4 major categories: Finance, Marketing, Product (or Content) Creation, Administration. For each income strategy, you will have 3-5 tactics you choose to execute that strategy. Each tactic will have many tasks (so many!) to execute the tactic. The lists of tasks will likely change on a weekly, or even daily basis as your plan evolves. As you put together your strategy, tactics, and tasks, you will start to build an outline of our business execution plan.

Here’s an example of an OSTT Framework outline:

Tasks will have a snowball effect. As you start figure out how to grow your income streams, you will find there are a gazillion things that need to be done, and hopefully they will be the sorts of things you enjoy doing. As your business builds, your tasks will change Some of them you may hand over to an assistant, in time.

Conclusion

The OSTT Framework was designed to provide a plan that you can adapt as your knowledge and business evolves. Its just the first step to executing your new strategy. You will also need a product or content creation plan and marketing plan, plus financials, KPIs, pro-formas, and other analytics to guide you as you grow and measure outcomes. These topics will be covered in length in an upcoming e-course on Advanced Personal Finance Strategy. Opt in for updates here.

Very interesting. I like the OSTT Framework Outline which makes things stick in my mind easier.

Such an important and timely post. Very important for these scary economic times!

A good overview of some strategic planning fundamentals summarized well into a single post. This would be a good basis for people starting out to think out and document in rudimentary terms, the why, what and how of where they want to go. Like how you have explained the differences of definitions pertaining to strategy versus tactics etc.

These tips are a must for everyone.let us not relay on our day time jobs because tomorrow is never guaranteed.

Wow wonderful tips and eye-opening post. Thanx for sharing

You’re welcome!

Such good tips to those who struggle to figure out how to prepare for their future (and their retirement).

A great overview of OSTT Framework Outline. This is so important at these times.

impressive sharing on prsonal finance tips, thanks for sharing the framework in an easier way for me to understand it 😀

cheers, siennylovesdrawing

OSTT Framework seems like a great tool to help with personal finances. I might have to use it for mine!

This information is so valuable, especially during this time. People are spending their stimulus check frivolously when it should be put in savings or invested.

This is a very good review, indeed very valuable information that will assist me in the future.

TIGP this is great post haha. I haven’t read about this framework before but it seems very interesting. We should consider when we want to be successful.

I usually do things manually mainly because I’m not very techie when it comes to handling finances. I’d check this out in the future as it looks promising and it doesn’t sound complicated to use.

This is a fantastic post, especially give the current low income rates during Covid 19 x

Marina Rosie x

https://www.marinawriteslife.com/

This is a really informative post! thanks for sharing!

OSST Framework? Nose bleed for me but wanna learn more on this, thanks for sharing

Sounds like an awesome tool. Love it and will help me in my finances.

Such an important and timely post. This is such an informational writeup!

This is such a great overview for this OSTT fireworks. It will help us for our future finance and in retirement.

Good to hear you found it helpful. Thanks for sharing!

Very interesting and informative post!! Thanks