If you’ve read up on money saving systems, you’ve probably heard of the envelope system. Its a simple method with the following steps:

-

Create an envelope for each type of monthly expense and identify an amount of money needed for the month.

-

Add the designated amount of cash into a labeled envelope to be used only for the intended purpose.

The first (and most obvious) problem with the envelope system is that nobody uses cash anymore. The second problem is there are too many buckets.

Three Accounts

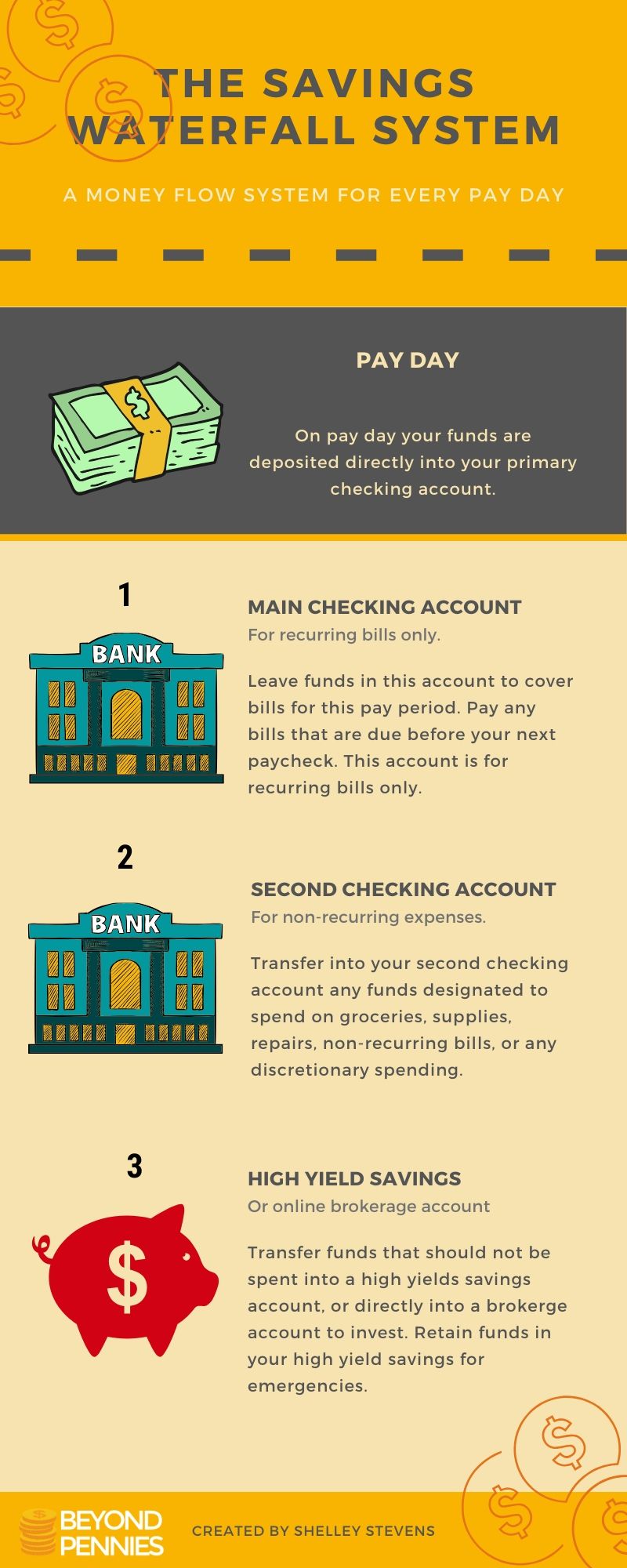

The Savings Waterfall System is a digital envelope system that uses bank accounts instead of physical envelopes. To use this system, you need three accounts:

- Main checking account – this is where your direct deposit goes.

- Second checking account.

- High-yield savings account.

Here’s how it works:

On pay day, you leave the funds needed to pay any recurring bills in your main checking account. Transfer into your second checking account the funds you plan to spend that aren’t recurring bills, for things like groceries, supplies, repairs and maintenance, and any discretionary spending.

The funds you have earmarked to NOT spend are deposited into a high yield savings account, and remain there until you decide how to invest them. You can also transfer the funds directly into an online brokerage account.

Follow Your Budget

If you use the savings waterfall system, you will find its much easier to follow your budget. The only debit card you should carry around is the one for your second checking account, where you transfer discretionary funds. When this account is empty, you are done spending until the next pay day.

So spend carefully.

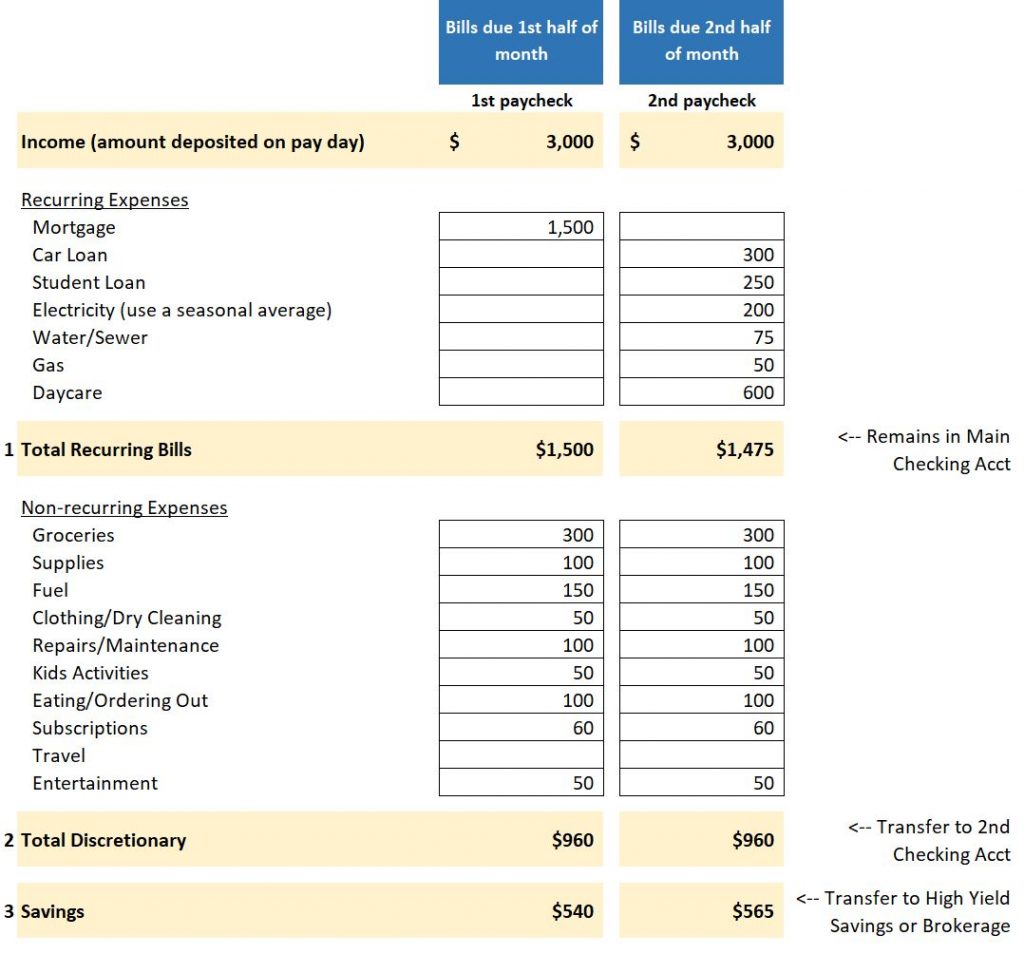

How Much to Transfer

If you aren’t sure what amount to transfer to each account, use your budget or last couple of months as a guide. List out each recurring bill you pay and the amount for each in a spreadsheet (Microsoft Excel or Google sheets).

See below for an example of a Funds Transfer Worksheet:

If you don’t want to start from scratch, download this Excel worksheet and adapt it to your needs.

Now here’s an important nugget of wisdom for you:

You don’t have to spend everything in your discretionary account! Leave some in there for next time, or build up a large balance for when your car breaks down or your cat rips a hole in your sofa.

Or better yet, transfer your extra discretionary funds that you didn’t spend to your high yield savings account so it can accrue interest until the sofa incident occurs.

I recommend always leaving a balance in each account in case you miscalculated, or a bill amount changes that you didn’t expect. You don’t want to run into an issue where you can’t pay something important because you’re short $10.

Free Online Accounts

If you use an online bank like Ally Bank, you can open as many checking and savings accounts as you want for free. They also offer savings accounts with competitive interest rates, and a brokerage account as well!

Another bank with a competitive savings rate is Axos. This bank also offers free checking accounts, and has been around for 20 years. It was one of the first online banks.

The nice thing about having your accounts tied together is that you can easily transfer money back and forth without delay. This works great IF you have self-discipline and don’t abuse the convenience by overspending out of your discretionary account. A one-stop shop for all of your accounts.

I use Ally Bank for my checking and savings, and TD Ameritrade (for IRA) and Tastyworks (for non-IRA) brokerage accounts. A little bit of separation between your wealth and your spending money is never a bad thing.

Conclusion

The Savings Waterfall System is a digital envelope system that coincides with your budget. It helps you bucket your money into three categories: recurring bills, non-recurring expenses, and savings. I hope this system helps you to maximize your savings and meet your goals.

Let me know below if you have a preferred system for bucketing your money.

I’ve started to do this and they are a big help

Great to hear!

i havent heard of this before but this is very helpful! Will definitely use this now! thanks

Interesting and informative post, thanks for sharing Shelley.

These are really great financial tips. I’m still pretty young and lean on my parents for financial advice, but seeing as I’ll be a working professional soon I need to be more knowledgable. Thanks for your information!

Very informative post with helpful tips and information, thanks for sharing! I’m going to try it!

We do everything online but we do maintain three kinds of accounts for different purposes. We have Spend to pay all our bills, Growth for savings and the other one is reserved for other expense. Very practical recommendations!

i havent heard about this but this gives me an idea. thank you for sharing! very practical…

Very practical tip! I’m new to this and would love to give this a try!

I love tips like this. I’ve been looking to adopt this type of automation for some time.

Cheers!

Great! You will love this system once you start using it.

My monthly income is quite unstable because I am a freelancer. Some months it is high, others it is low… that makes this system quite hard for me to follow, I think.

Thanks for sharing this informative post. I’ve been trying to implement it.

I do this somewhat, but I was wondering if three different accounts are necessary?

The idea of using three accounts is key in segregating your funds. If you only want to use two, you would use your main checking and a high yield savings account. You should always keep your extra cash (emergency funds) in a high yield savings account where you can generate some interest. The bank uses cash from your account and others to provide liquidity to their operations, and they should pay you a fee for that (interest). If you leave large balances in your checking account, you are allowing them to use your funds for free. Put your money to work for you!

This is an incredible system! As an entrepreneur, our income fluctuates from month to month, so having a system like this can help add regularity- and more importantly help to prevent us from over-spending when we’re having a particularly great month and we feel more inclined to ‘splurge.’ Thanks!

Managing my finances as an entrepreneur has been one of the most challenging aspects of running an online business, but this article has really helped. thanks a lot

This is the first time that I heard of Digital envelopes. Thanks for sharing.

Thanks for basic advice. I’m finding this covid crisis (with people losing their jobs) is making many think about how to save and prepare for the future. These digital envelopes might help with that thinking.

I love using this system in my life!

It helps me budget and get more for each and every dollar. Thanks for getting the information out to more and more people!