Guest post by Gavin McMaster

Gavin McMaster is the creator of Options Trading IQ, one of the best sites on the internet for learning option income strategies.

The world of options can seem a foreign place when people first encounter it. It’s rarely, if ever, mentioned in mainstream media. But did you know that Warren Buffett uses options extensively in his investing?

As with any type of trading, it pays to become familiar with the important concepts and procedures before diving in and executing trades. This article will help you on your journey by teaching you one of the most fundamental elements of option trading: the call option.

What Are Call Options?

Simply put, a call option is a contract between a buyer and seller. The contract will be for the right to purchase a certain stock at a certain price, up until a certain date (called the expiration date).

What this means is that up until the contract expires, the buyer of a call has the right to purchase the stocks at the agreed price. Completing this act is called exercising the option. It’s important to note, that a call option provides the buyer with the right to purchase and not an obligation. So if a buyer decides not to exercise the option they can let it expire worthless.

On the other hand, the seller of a call option has an obligation and not a right to deliver the stock if the buyer exercises the option. This means they have to provide the stock and can’t choose to just let it expire when a buyer exercises the option.

Call Option Example

Let’s assume an investor wants to buy 100 shares of XLU – The Utilities ETF from SPDR. To buy 100 shares, the investor would need to invest $5,980 in cash at the current price of $59.80.

That’s a lot of money to risk and the investor could (in theory) lose that entire amount if XLU goes to $0.

Instead, the investor could gain the same exposure using a fraction of the capital by buying a call option.

One call option gives the investor exposure to 100 shares.

If the investor were to buy 1 XLU $30 call option expiring in Jan 2022, they would only need to invest $2,965 rather than $5,980. If XLU goes to $0, the investor loses only $2,965 while still maintaining a similar exposure to the gains.

The XLU $30 call option gives the investor the right to buy 100 XLU shares at $30 each (called the strike price) up until the expiration date.

The call option cost $29.65 so the investor would need XLU to rise above $59.65 (strike price plus premium paid) in order to be profitable on the investment.

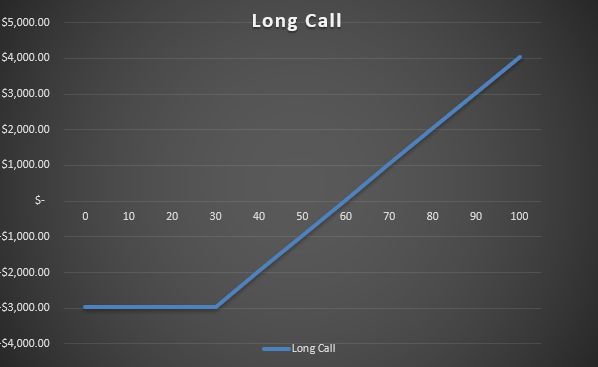

Here is what the payoff diagram looks like. Notice that the downside is limited but the upside is very similar to outright stock ownership.

Buying a call option is just one of numerous possible option strategies, but it is a very easy one for investors to get started with.

It’s important to remember that options are risky and investors can lose 100% of their investment.

However, a long call option, when done correctly, can be a great way to gain exposure to a stock or ETF with the same upside potential and less downside risk.

Thanks for reading.

Gavin McMaster,

Hi Shelley,

Thanks for posting this article. I’ll make sure to check the comments in case anyone has any questions.