In 2019, the average net worth of a 40 year old American was $428,000 according to a Survey of Consumer Finances publishes by the Federal Reserve. [1]

Does that seem like a big number?

Like me, you might read that and feel like you are way behind the curve. Before we jump to conclusions, let's take a closer look at the data.

As you can see in the chart above, there's a large disparity between the net worth of the top 10 percentile and the 0 – 89 percentile. The top 10% category is skewing the average net worth to a much higher number than represents the true average.

We can remove the top 10% from the calculation and see what the new average net worth is for 35 – 44 year olds.

The chart above shows a new average net worth calculation that doesn't include the top 10% of wealthy Americans who fall within the 35-44 year old range.

The result is a significant reduction in average net worth. The overall average is $428,000, and the average using the bottom 89.9% of Americans in that age range is $187,000. This calculation is a much more realistic number to use as a benchmark.

Since an average value can be distorted by outliers, the median is sometimes a better indicator of central value.

The median net worth of 35-44 year olds in 2019 was $91k.

So take your pick – use $187,000 average net worth or $91,000 median net worth as a benchmark for your personal net worth calculation.

Why Net Worth Is Important

Net worth is a snapshot of your overall financial health. There's no better way to accurately measure your wealth. Its also the best way to track your progress over time.

It doesn't matter how low you're starting. Some of you with alot of debt will start out with a negative net worth. I did. By tracking it, you can see the effect that paying down debt has on your financial health.

As your debt goes down, net worth will turn from negative to positive. Tracking net worth can be a great motivator to keep going down the path of healthy financial habits.

For those who focus only on assets, they may not realize that if their liabilities grow at the same rate, they aren't gaining any wealth.

For instance, if your income goes up and you contribute to your 401k, you may feel like you are gaining wealth. But if you're also taking out new loans, racking up credit card debt, or borrowing money for expensive cars, you may not be gaining any financial traction.

The net worth calculation will give you the best insight into your true financial state.

What Your Net Worth Is Not

Your net worth is not your income.

Its not your income because you don't keep all of your income – you spend some of it on living expenses, debt payments, vacations, etc.

The only income included in your net worth is the income you don't spend.

Despite what some Americans believe, you don't need a big income to build wealth. You just need to have a lower cost of living than your income, and be disciplined enough to save the rest.

And once you save up, you can invest your unspent income and let it generate passive income for you.

How to Calculate Your Net Worth

Net worth is the amount of money you would have if you sold all of your assets and paid off all of your debts.

To calculate net worth, start with your assets. Add up your cash on hand, bank balances, investment balances including any stocks, options, cryptocurrency, futures contracts or other financial securities. This should include 401k, IRA balances, and any other retirement funds.

Also calculate the current market value of any real estate, including your primary residence. If you have any antiques or other collectibles with a known market value, you can count those as well.

Pro tip: I use Zillow's Z Estimate as the estimated value for my home. Its not perfect, but its an estimate calculated by a third party that's updated every month. Short of getting a new appraisal completed, this is the best market estimate I have.

Generally non-collectible vehicles for personal use are not included in net worth calculations.

Next, add up your liabilities. This section should include all credit card loans, installment loans, car loans, mortgage balances, home equity loans, future vehicle lease payments, student loans, and any other debt owed.

After you total your liabilities, the math is simple:

Total assets – total liabilities = Net Worth.

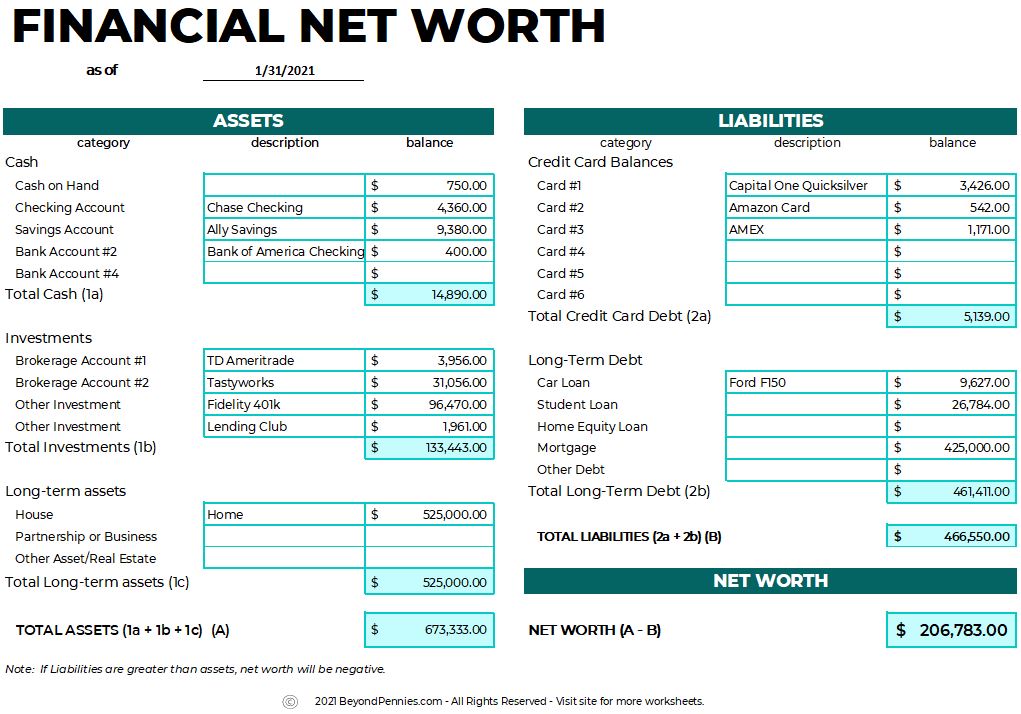

Free Net Worth Printable Worksheet

Here is a free net worth printable worksheet template you can use to track your own net worth. I recommend printing and updating this sheet on a monthly basis.

How to Increase Your Net Worth

There are several ways to increase your net worth. Here are the biggest priorities to make the largest impact:

- Pay off credit card debt

- Contribute to 401k

- Pay off long-term loans (cars, student loans, etc.)

- Save and invest post-tax funds

- Invest in a company

- Pay off your mortgage

All of that happens by increasing your income and/or decreasing your cost of living. If you want to dig deeper into your finances, read this post on building your own DIY budget binder (with free worksheets to use!).

Automate with an App

If you're interested in a free app that tracks your net worth for you, take a look at Personal Capital. I've used this app before and it does help automate the process of calculating net worth.

Visit Personal Capital's website here and try it out.

However, it removes some of the engagement required to calculate it yourself. I'm a big believer in engagement and spending quality time with your finances.

[1] https://www.federalreserve.gov/publications/files/scf20.pdf

INVESTMENT QUIZ

I am really surprised at the average net worth of a 40-year old!