In March 2020, most Americans received a $1,200 stimulus check from the US Treasury because of the CARES Act, a bill passed by Congress and signed by President Donald Trump.

Families received checks of $1,200 for each adult, plus $500 for each dependent. Many Americans used the stimulus money to pay the rent, purchase food, or fill other financial needs while out of work.

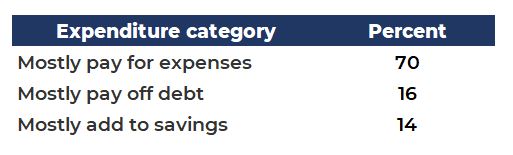

The U.S. Bureau of Labor Statistics conducted a survey in June of 2020 to see how consumers were spending their stimulus checks. According to the results, 70% of those who responded to the survey planned to use their payment mostly to pay for expenses, 16% to mostly pay off debt, and 14% planned to add to savings.

These percentages were adjusted to remove the 14% of those surveyed who did not respond.

Percentages adjusted to remove the 14% of those surveyed who did not respond or expect to receive a stimulus check.

What if you had invested your stimulus check in stock market? What would be the outcome?

Let’s ASsume…

- You received a stimulus check for $1,200

- And then purchased shares of an index fund that tracks the S&P 500 on May 1st

- You did not sell any shares until Jan 20, 2021

What would be the value of your stimulus check on Jan 20, 2021?

Calculation

On May 1, 2020, the S&P 500 Index (ticker symbol SPX) was worth $2,919.61. On January 20, 2021, the S&P 500 Index is worth $3,842.84 (midday price).

If we find the difference between the above two prices, we can see that the S&P 500 increased $923.23 in value during that time period ($3,842.84 – $2,919.61 = $923.23).

If we divide $923.23 into the original price of the index, $2,919.61, we calculate an increase in value of 31.6%. ($923.23 / $2,919.61 = 31.6%)

Apply the 31.6% to your $1,200 stimulus payment to find out how much you would have gained on the value of your stock.

31.6% x $1,200 = $379.46.

Now let’s add that to your original stimulus check value of $1,200:

$1,200 + $379.46 = $1,579.46

Adding it Up

If you had invested a $1,200 stimulus payment into an index fund that tracks the S&P 500 on May 1st, 2020, as of Noon on Wednesday, January 20, 2021, your investment would be worth $1,579.46.

Maybe you spent your check on frivolous things, or maybe you were unemployed and spent it on bills. Either way, you may get another opportunity to invest a stimulus check.

Joe Biden’s proposed American Rescue Plan includes sending out $1,400 checks to each American. If the bill passes, consider ways to put those dollars to work for you. Investing in the stock market is just one of many ways to invest your money.

There are no guarantees the stock market will go up in 2021. However, the historical trend of the stock market over the last century tells us its likely to increase in value over the next 10, 20 and 30 years.

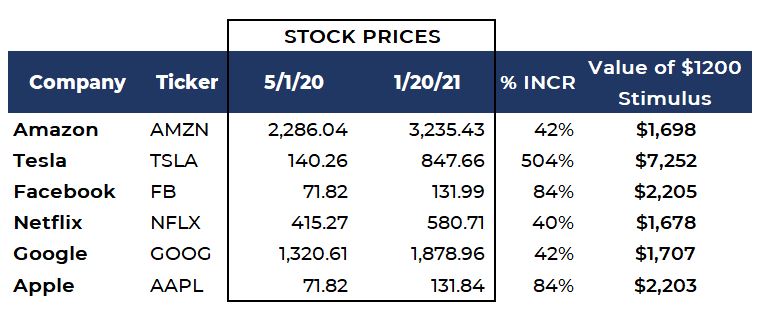

What About Specific Stocks?

What if you invested in specific stocks with the same amount of money, over the same time-frame? The chart below shows the results of investing $1,200 in Amazon, Tesla, Facebook, Netflix, Google, or Apple on May 1st, 2020, and selling those shares around Noon on January 20, 2021..

Choose Wisely

Should you invest your next stimulus check into the stock market? Truthfully, only you can decide whether that is a good choice for you and your family or not.

If you have credit card debt or other high interest debt, you will gain much more by paying it off than you will from investing in the stock market. After you debt is paid off, start saving the amount you were paying the credit card company every month.

Don’t just save money, though. Put it to work earning extra dollars for you by investing it. As Warren Buffet once said, “If you don’t find a way to make money while you sleep, you will work until you die.” -Warren Buffet.

How Will You Spend Your Next Stimulus Check?