The Definition of Keeping a Household Ledger

Keeping a household ledger means writing down all of the money you spend every month or pay period. Its basically a spending log. The spending log should include the following information:

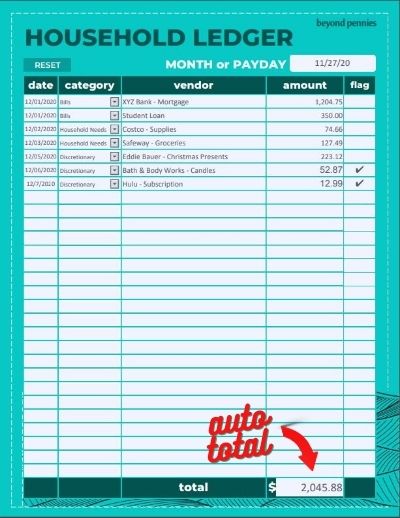

- Date

- Category or type of expense

- Person or company you paid

- Amount you paid

How Keeping a Household Ledger Helps Save money

One main reason people spend too much money is they don’t pay attention to what they’re buying and how much it costs.

That 7-11 hot dog was only a few bucks, and hey, you needed a new pair of shoes, right? The “buy one, get one half-off deal” seemed too good to pass up, so now you have two new pairs. Remember the $9.99 Starz add-on to your Prime account you bought so you could watch that show you were interested in? No, you didn’t remember. You planned on canceling it four months ago, but it never happened. You forgot.

Have you ever looked at your bank account a week after payday and noticed that almost all of your money was spent? Where did it go?

Keeping a household ledger eliminates the lack of awareness in how your money is spent. In fact, it makes you hyper-attuned to where its going because you invest quality time in tracking it every week.

This is not wasted time. It is time well-spent.

A household ledger keeps you informed. No more surprises – you will know how every penny is spent.

Materials and tools

To get started keeping a household ledger, you don’t need anything fancy. A notebook, the back of an envelope, a spreadsheet, a bullet journal, or a pre-made fillable PDF worksheet will all work.

For a fillable PDF worksheet that you can type and then print, or print and fill out with a pen, download my free file:

Please note: If you decide to fill in the PDF on your computer, you will not be able to save it unless you have the full version of Adobe Acrobat. Adobe Reader will allow you to fill it out, but not save it. However, you can print it blank and use it, or fill it out on your computer and then print it before closing the file.

Steps to Keeping a Household Ledger

Step 1

Decide whether you want to track your spending by pay day, or by month. Both options have pros and cons.

I like tracking expenses by pay day, because I also like planning how I’m going to spend every paycheck before it is deposited into my account. That way, I already know how much I need to spend, and how much of it I can save.

However, tracking by payday makes it harder to compare spending from one pay day to the next because sometimes you will not pay the same bills every payday.

Tracking monthly eliminates the problem of comparing spending from one period to the next, but it makes it more difficult to plan because many of us are paid on a bi-weekly basis, or once every two weeks. That means twice every year you will receive three paychecks instead of two, and you will be able to skip paying a bill every now and then. When that happens, its important to have a plan to save that money instead of spending it.

Step 2

Whether you decide to keep your household ledger by payday or month, enter the details on your ledger every time you buy something or pay a bill. You will do this daily or weekly.

Waiting until you reach the end of the period to record your spending is not a good idea because you won’t be aware of how you’re doing until the end.

Assign each transaction a category to make summarizing spending easy. Compare prior period totals to the current period to show if you are spending more or less over time. Fewer categories make summarizing more simple.

Here are the categories I like to use:

- Bills – these are payments you make every month to pay for your house or apartment, utilities, cable and phone, childcare, car payment, and all other monthly payments except for credit cards.

- Household needs – this category includes all the normal stuff you need to live. Groceries, supplies, repairs & maintenance, fuel, and any other necessities to survive in this crazy world.

- Discretionary – include any things you bought that you didn’t really need. Beer, wine and liquor, entertainment, eating out, vacation, gifts for yourself and others, luxury items, and other non-essential spending.

- Credit Card Payments – use this category to add up all the credit card payments you made. This bucket will be zero eventually, when all of your credit card debt is paid off. Yay!

- Savings – any transfers to savings or investment accounts.

- Other – you may want to have a bucket for recording business expenses if you are self-employed, starting a new company, or launching an online business. This category is not included on the free worksheet, but could be added manually, if needed.

Step 3

Flag any purchases you want to reduce or eliminate in the future. Flags are a great way to manage your spending and make quick improvements.

Simply flag it, and then at the end of the period, go through each of your flags and write a quick phrase or sentence explaining how you will reduce or eliminate a similar purchase next period.

Step 4

The final step is to plan for the next period.

Decide three things:

- How much you want to spend in each category.

- How much credit card debt you want to pay down.

- The amount you want to save next period.

Then identify ways you can spend less money. Choose one to three ways to target the next month or pay period.

How is Keeping a Household Ledger Magic?

Keeping a household ledger is a key way to improve your spending habits. It works by improving your awareness, and by focusing on present and near-future spending decisions.

For the best results when keeping a household ledger, do the following:

- Assign categories to your purchases for easy comparison of spending to prior periods

- Flag purchases to reduce or eliminate next time

Try keeping a household ledger for a few months. You will magically grow an awareness of your financial habits. You will magically begin to manage your own spending like a pro.

It really is magic.

WHAT IS YOUR BIGGEST ROADBLOCK TO SAVING MONEY? SHARE IN THE COMMENTS BELOW.